How It Works

STRATEGY WORK

How Our Strategy Work

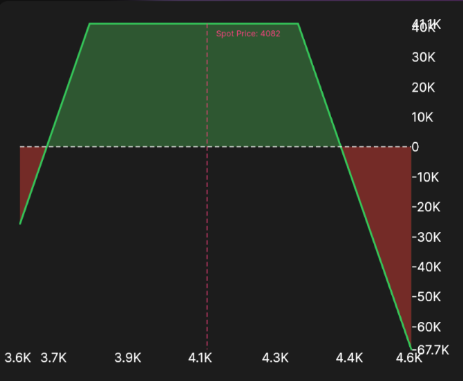

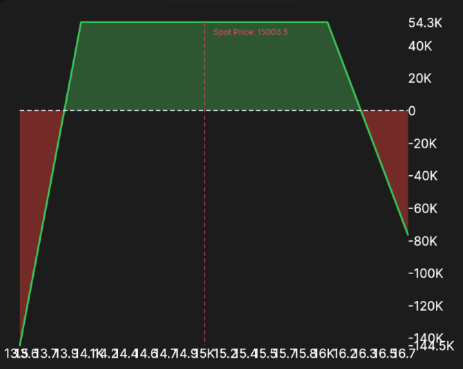

The fund trades options strategies across various global markets to create ranges in which profits can be made from the passing of time. Entries are made using proprietary methods using technical analysis and macroeconomic developments.

We trade 3-6-9 months out in quarterly expiring cycles across global indices, forex and commodities.

EU SAMPLE POSITIONS

DAX SAMPLE POSITIONS

Horloge Capital, where we specialize in selling time to deliver consistent returns and maximize opportunities for growth, all while minimizing risk.

Investment Route

Investing with Horloge Capital

-

Becoming a Limited Partner

Investors who wish to participate will become limited partners of Horloge Capital LLP. Your details will be registered with companies house.

-

Tax-Free Profit Distribution

Profits generated through our investment activities are distributed tax-free to our limited partners, you are then responsible for making your declarations to the tax authorities.

-

Fee Structure

There is a transparent fee structure in place to ensure fairness and accountability. We charge a 2% annual asset management fee and are entitled to 20% of profits generated, collected at the end of an investment year. Our fees are competitive and aligned with industry standards, we want to grow the fund and would like investor funds to grow with us.

-

Investment Requirements

Interested investors must meet certain investment criteria to participate in our program. The minimum investment amount is £25,000, the fund uses sophisticated products to achieve its goals and Investors should be aware of the instruments we use. Your capital is always at risk, and investors should only invest that in mind.

Performance Metrics

At Horloge Capital, we pride ourselves on our track record of success. Here are some key performance metrics to consider:

Historical Returns

Our accounts, including Commodities, Long Term, and Family Office, have consistently outperformed the market, delivering impressive returns to our investors.

Resilience in Market Conditions

Our investment strategy has demonstrated resilience in various market conditions, weathering storms and capitalizing on opportunities to deliver consistent returns over time.

Key Performance Indicators

We utilize key performance indicators and benchmarks to evaluate the success of our investment strategy and ensure that we're delivering value to our investors.